Staying ahead

in the transition towards

sustainable mobility

International Congress and Expo | 3 – 4 December 2024, Estrel Hotel, Berlin

Call for Papers 2024 – Hand in your Topics!

Considering the scope of the challenges still ahead, an interdisciplinary exchange between automobile manufacturers and suppliers at all levels is essential. The CTI SYMPOSIA are the ideal meeting ground for manufacturers of passenger cars and commercial vehicles, system and component suppliers, engineering service providers, software developers, and market specialists.

We look forward to your presentation proposals for our 23rd CTI SYMPOSIUM in Berlin.

Prof. Dr Malte Jaensch

Chair of Sustainable Mobile Powertrains,

Technical University of Munich

Chairman, CTI SYMPOSIUM GERMANY

The Powertrain as an Intelligent System

The automotive world is changing, and the CTI Symposium is helping to drive the transformation. Where will the boundaries of powertrains lie in future? While powertrains will still be centre stage of the Symposium, the scope will expand. Artificial intelligence will play a growing role, and so will the provision of energy sources.

Speakers 2023

Impressions 2023

Topics 2023

- Transformation of the Automobile and Supplier Industry

- Latest and Future EVs

- Mobility and Transport Concepts

- Transformation of the Propulsion

- Panel Discussions:

- The „BEV for Everybody“

- Who Will Take the Commercial Vehicle Volume?

- Deep Dive Sessions on Passenger Cars and Commercial Vehicles

- E-Drives, E-Motors

- Thermal Management, Battery System Technologies

- Markets – Strategies – Supply Chain

- FCEV, HEV

Strategies and technologies for carbon-free mobility

The automotive industry is transforming rapidly towards zero-emissions mobility.

While net zero emissions can be achieved with different drive systems and primary energy carriers, all solutions have one thing in common: CO2-neutral mobility based on renewable energy sources.

The International CTI SYMPOSIUM and its flanking specialist exhibition is THE industry event in Europe dedicated to sustainable automotive powertrain technologies for passenger cars and commercial vehicles. The event brings together automotive decision makers and industry experts discussing latest strategies, technologies, innovations and the automotive powertrain as part of the greater energy transition!

Extensive OEM and supplier reports & panels

Hundreds of delegates and companies from 20+ countries attending

100+ speakers and panelists

Deep dive sessions

Extensive exhibition for powertrain technologies, components, materials and engineering solutions

25+ Hours of content & networking

CTI Symposium USA

15-16 May 2024

Updates from cti-symposium.world

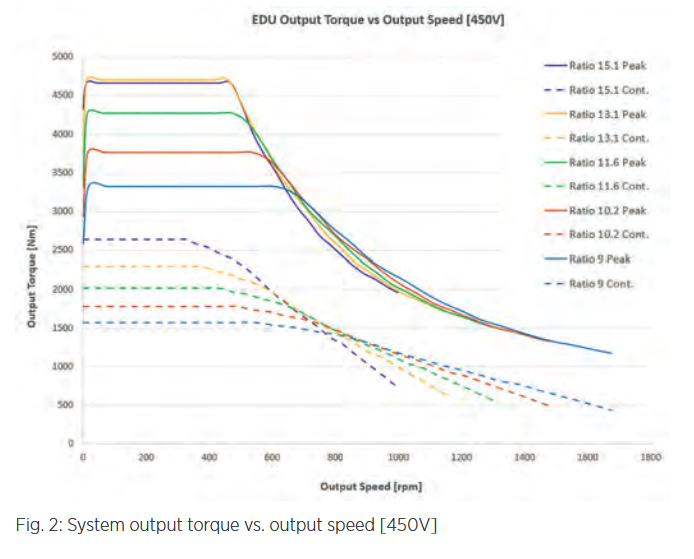

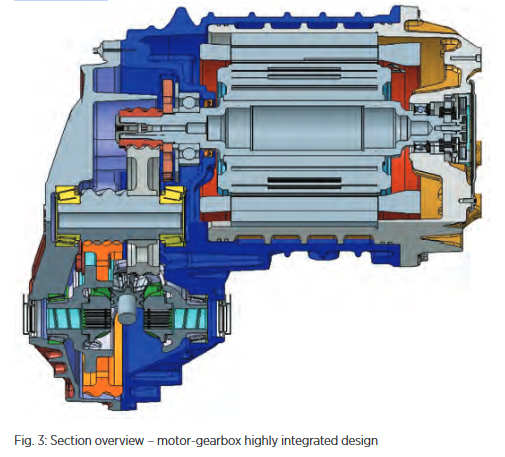

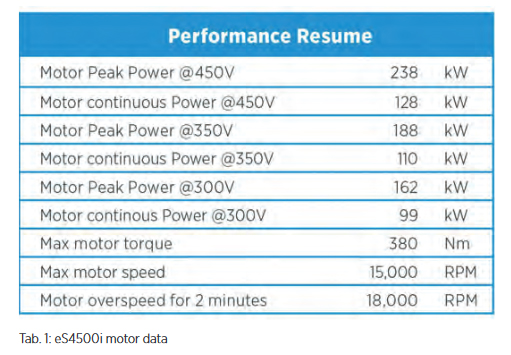

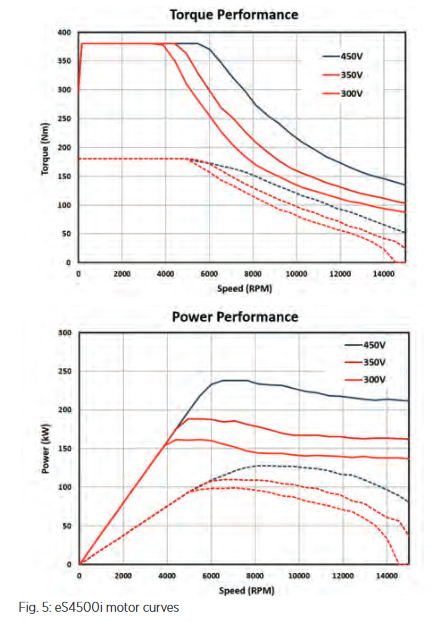

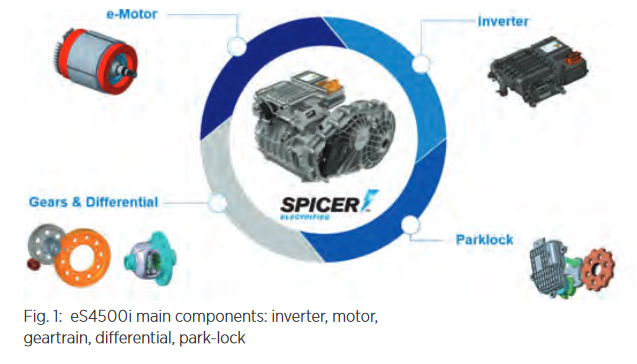

eS4500i: Highly Integrated Electric Drive Unit for Multiple Applications

Marco Silvestri, Chief Engineer, Dana Incorporated Across all our actions, we never lose sight of a guiding vision toward a zeroemissions future. This has powered our first-mover advantage in electrification. At Dana, we strategically invest in technical competence − designing, engineering, and manufacturing the components of a complete e-Propulsion system in-house. These innovations include efficient […]

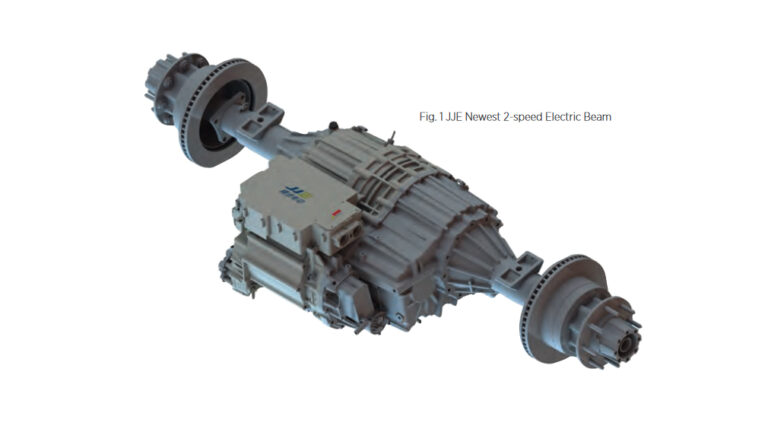

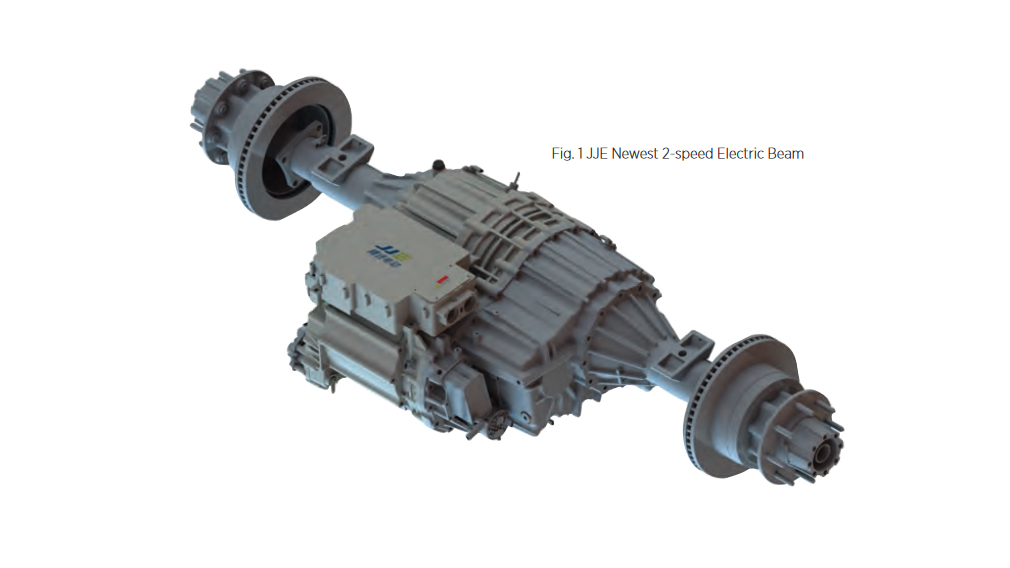

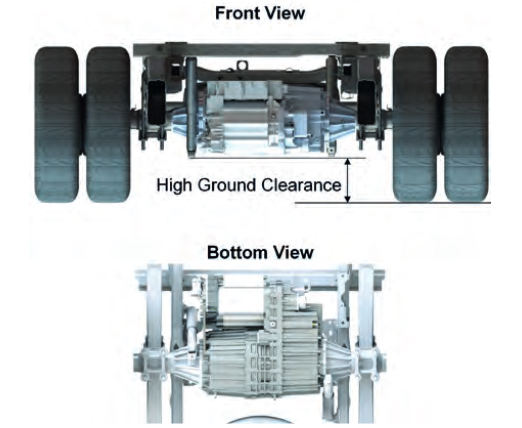

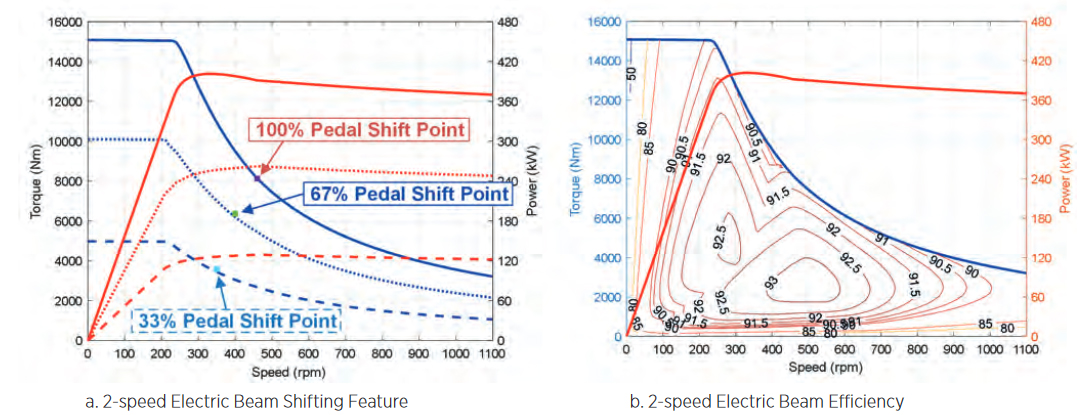

Continue readingJJE 2-Speed Electric Beam Axle for Medium Duty Truck

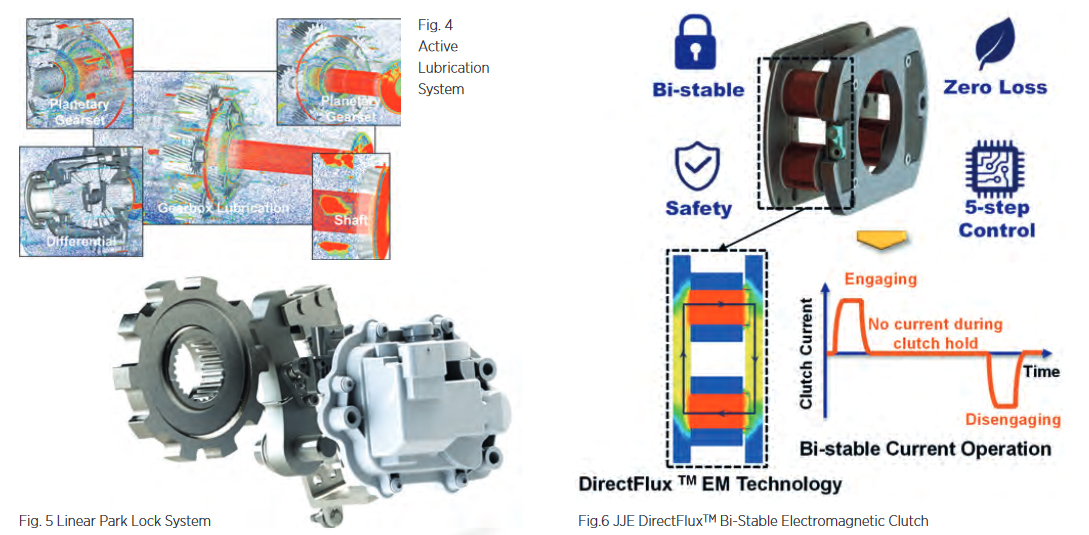

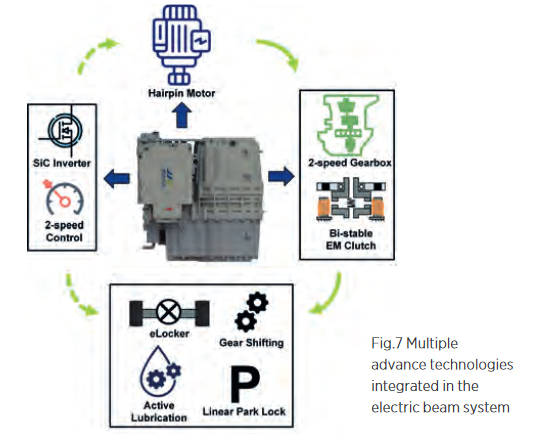

Ping Yu, CEO, Chief Engineer, Founder, Jing-Jin Electric Dr. Yang Cao, Transmission Senior Supervisor, Jing-Jin Electric The electrification of medium duty truck grows rapidly. JJE’s newest electric beam axle family can cover up to 11T (or class 6 in North America) trucks, including single-speed and 2-speed systems. Multiple advanced technologies are integrated into the electric […]

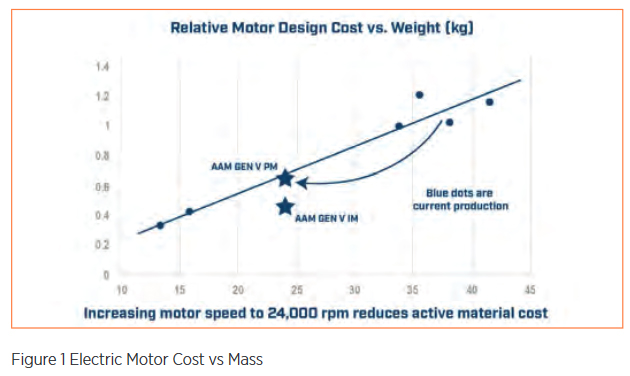

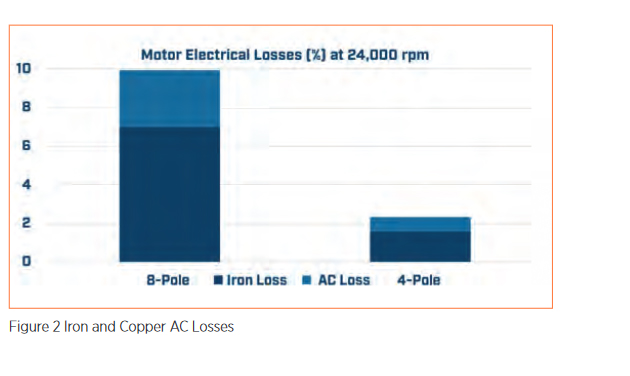

Continue readingOvercoming Challenges to High-Speed Electric Motors

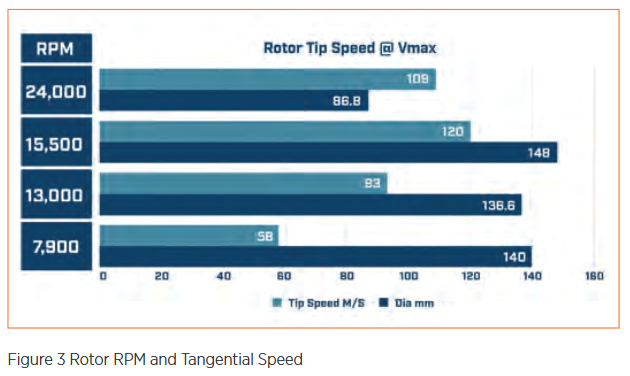

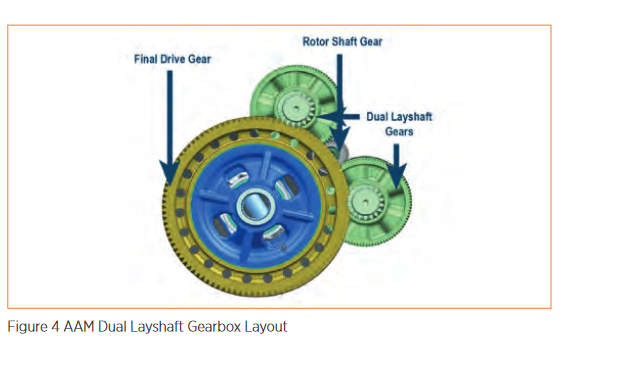

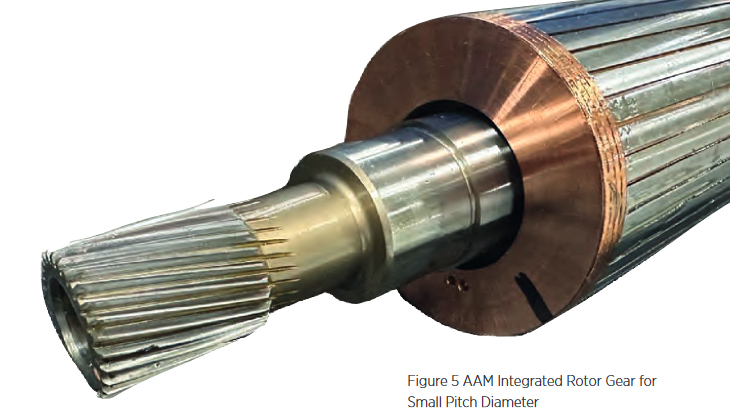

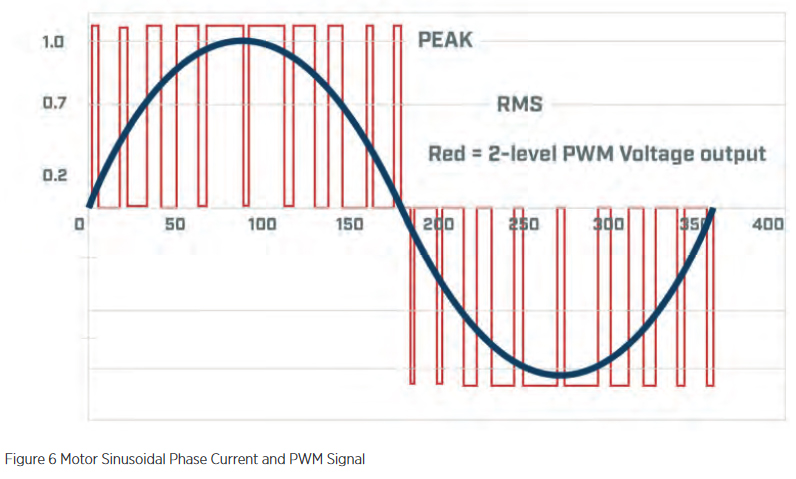

Craig Renneker, Vice President Innovation, AAM While the EV growth rate remains uncertain, there is little doubt that the use of automotive electric drive units must drastically increase to meet global climate objectives. This requires mass market acceptance across the full range of vehicles − size and price. A major enabler to reaching more customers […]

Continue reading

The legislation for pollutants and emissions is driving OEMs to design their reduction programs to align with aggressive timelines — accelerating the adoption of electrification. These mandates, coupled with corporate commitments from OEMs, will significantly increase the demand for electrified vehicle architectures, the main components of a Battery Electric Vehicle.

The legislation for pollutants and emissions is driving OEMs to design their reduction programs to align with aggressive timelines — accelerating the adoption of electrification. These mandates, coupled with corporate commitments from OEMs, will significantly increase the demand for electrified vehicle architectures, the main components of a Battery Electric Vehicle.