Participants:

Ulrich Walter (host)

Prof. Dr Arno Kwade, Director, Institute for Particle Technology, Technische Universität Braunschweig

Uwe Wagner, Chief Technology Officer and Member of the Board, Schaeffler

Christian Levin, Chief Operating Officer, Traton

Dr Bernd Vahlensieck, Senior Manager E-Mobility & Powertrain, ZF

Prof. Dr Christian Beidl, Head of Institute for ICEs and Drives, TU Darmstadt

Stronger investments in electrification

The automotive industry is in the middle of a restructuring process shaped by digitization and automation, but also the reduction of CO2 and pollutants. As a glance at the latest models on offer makes clear, hybrid and all-electric drives are all set to go mainstream. But that shift comes with a price tag, and now the industry faces the pressing question of how to develop and build these automobiles on terms their consumers will accept.

This prompted the first question in the panel discussion:

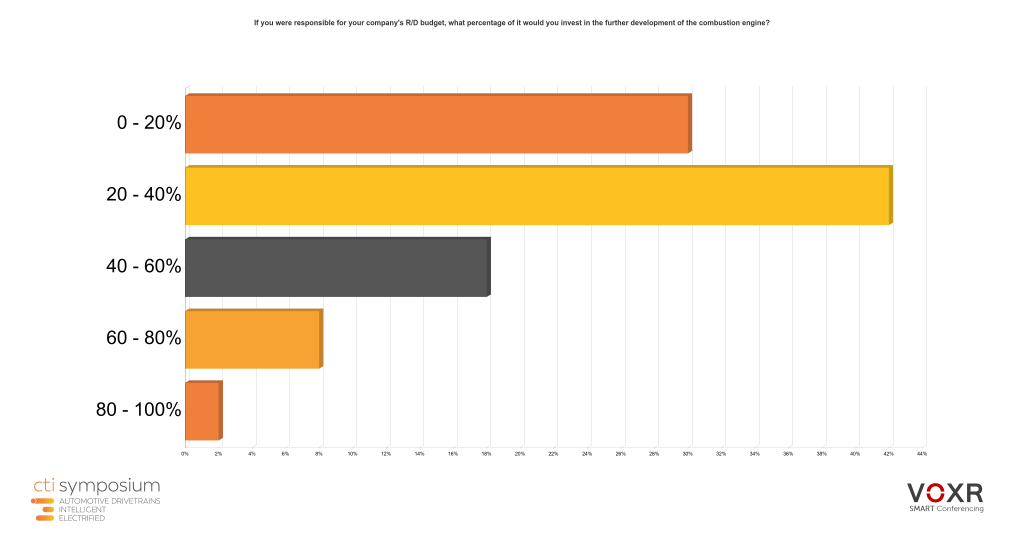

“If you were in charge of your company’s R/D budget, what percentage would you invest in further development of combustion engines?”

As the numbers show, the audience – responding as usual live via smart phone – had a clear opinion: Yes to further investment in ICEs, but a big share of budgets will be going elsewhere.

Ulrich Walter then effectively stood the question on its head by asking the audience:

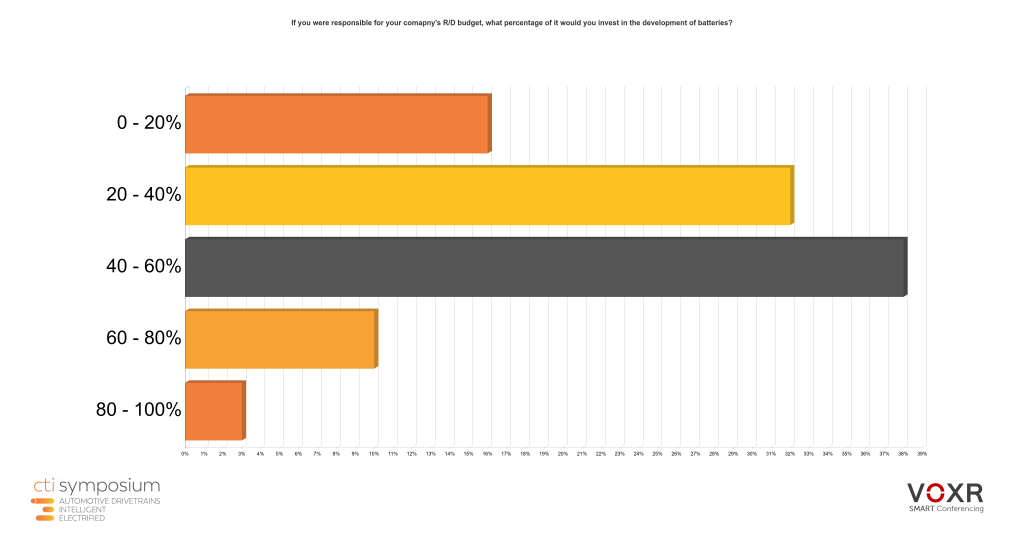

“If you were in charge of your company’s R/D budget, what percentage would you invest in the further development of batteries?”

Taken together, these two questions showed a clear trend: Invest substantially in electrification, but without neglecting ICEs.

Consumers want it all – but without paying more

So much for the investment side – but what’s the consumer view? In a video survey held in advance, CTI asked people in Germany, China and the US what they thought.

“What are your criteria when buying a car?”

The answers were extremely varied and included criteria such as modern infotainment, image, brand, versatility, roomy interiors, low maintenance costs, reliability and the ability to get people from A to B. Only one person named the drive and its performance as an important decision-making criterion.

In Bernd Vahlensieck’s opinion, those answers were an accurate reflection of the ‘balancing act’ the industry is currently involved in. On the one hand, customers had lots of expectations, some of them new; on the other hand, manufacturers needed to reduce carbon emissions and promote electrification. Vahlensieck was slightly disappointed that drives were hardly mentioned. Uwe Wagner said that actually, customers only want to pay for range, performance, etc. – not for less CO2. So to bridge the gap until affordable electrified drives prevail, the industry should use the full spectrum of conventional and electrified drives.

Another international survey asked a very specific question:

“Can you see yourself buying a hybrid or an EV?”

According to participants, infrastructure is even more of a sticking point than range. One person gave a vivid example: “I live in an older residential area and park on the street at night. So I’d have to hang a lead from my second-floor window – and most of the time I can’t park in front of my house anyway.” This was probably why an interviewed person from China preferred plug-in hybrids, which combine electric driving with the ability to use fuel on longer journeys.

Professor Kwade noted drily that in cities, the best solution was to have no car at all. City charging infrastructures still posed challenges, and there was no perfect solution. Options such as inductive charging or putting charging points in lamp posts were very expensive. Uwe Wagner advocated hybrid drives that use dedicated ICEs instead of just lumping two technologies together, saying this could cut costs.

Professor Beidl confirmed the results of the survey by saying that availability, not range, was the biggest issue for drivers. “If we can learn one thing from these answers … it’s that customers expect the same level of functionality they have already.” According to Christian Levin the same goes for the commercial sector, where the ability to charge wherever needed is what matters most.

How much are customers willing to pay for emissions-free driving?

At the end of the day, another important question remains:

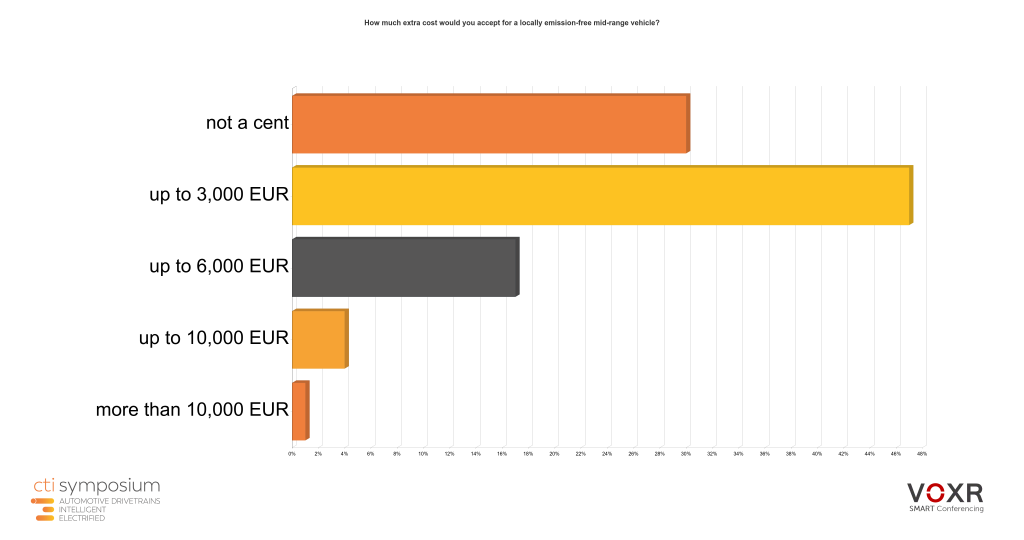

“How much extra cost would you accept for a locally emission-free mid-range vehicle?”

A surprising number of participants were ready to pay up to €3000 more for zero-emissions driving, while a good third opted for ‘not a cent’. Here again, CTI ran a video survey in advance. This showed two main trends: some people were not willing to pay anything extra; others were, providing the EV in question was ‘particularly fascinating’.

But as Christian Levin pointed out, what matters most in the commercial vehicle sector is TCO, not purchase price. Professor Kwade said that should actually apply to cars too, and BEVs could also turn out cheaper in the long run.

Bernd Vahlensieck pointed out that the extra outlay made much less of a difference on big company cars than on small cars, so private individuals tended to be hit harder.

Batteries could still charge a lot faster

Finally, the panel turned to the status quo in battery technology. Professor Kwade said Li-Ion still had 30-50% more potential, while solid-state batteries could increase volumetric energy density by a further 20 to 30%. But that was about as far as it went. The more important question was, how quickly can you charge the cells? Kwade said there was still much to be done here in terms of cell structures and materials.

Which brings us to the final question for the audience in Berlin:

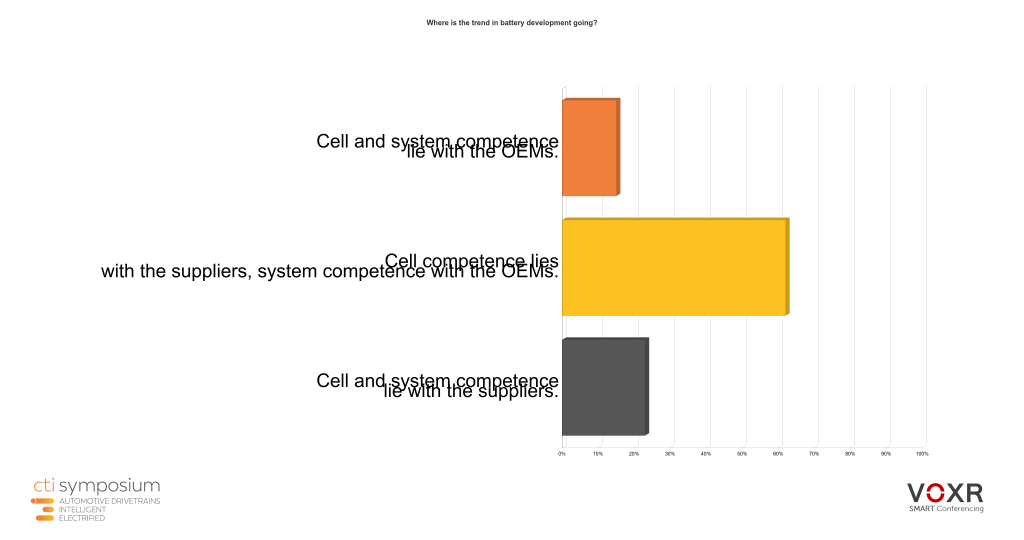

“Where is the trend in battery development going?”

“Where is the trend in battery development going?”

The result was clear: system competence is expected to rest with OEMs; cell competence will mostly rest with suppliers. The big question is – where exactly will that be?

Professor Kwade said Germany or Europe could keep pace with Asia in terms of technology, but had less experience with mass production. Uwe Wagner thought there was little point making batteries in Germany at present, as there was not enough regenerative energy to do so ‘cleanly’. But in terms of development, striving for a leading role was definitely a good idea.

Vahlensieck said ZF was not developing batteries because there were too many players on the field already. But in the context of systems – and batteries were part of an overall system – ZF too was working intensively on battery technology.

Efficient drive technology is not enough

In response to Ulrich Walter’s question of whether hydrogen might be the better choice for long-distance traffic, Christian Levin weighed up two different aspects. On the one hand, vehicles themselves needed less ‘material’ with hydrogen; on the other, the price of producing hydrogen regeneratively remained to be seen. He said hydrogen was a useful addition, but batteries still performed better in many scenarios.

Uwe Wagner then touched briefly on the political debate. The thinking here is that while hydrogen is comparatively inefficient at just over 20%, production still makes sense if you use regenerative electricity that cannot be sold short term. Also, scaling up production could restore the balance economically.

Professor Beidl took the view that we are currently in a ‘green start-up phase’ and need to gain experience. Instead of thinking in terms of either/or, all options – including meaningful coupling between different sectors – should be on the table. He said the yardstick was not just efficiency, but above all availability and vehicle usage profiles too.

In other words, there is no silver bullet. For driving to remain affordable, the industry will have to keep up its balancing act and find the most efficient solutions possible.